Sorting files and instituting filing cabinet processes have been phased out in today’s digital information era. Antiquated paper-based methods of creating, storing, and distributing information have been replaced in the business world with digital file storage and sharing. Physical data rooms have traditionally been required to house and share confidential information in a secure and controlled environment. This required a physical location as well as intense security protocols and inefficient processes and procedures. With likely mergers and acquisitions (M&A) buyers, investors, sellers, and other interested third-parties scattered across the planet, however, secure virtual data rooms can help bring together all stakeholders to review confidential documents and valuable data wherever they happen to be.

A virtual data room (VDR) is a secure online platform designed for, storing, sorting, and sharing confidential files. Companies, financial institutions, and a host of other organizations can use VDRs to house information, data, intellectual property, and confidential documents such as those needed for M&A transactions. Virtual data rooms can enable document sharing and allow organizations to control digital rights management with restrictions on user access and document permissions. VDRs have become a critical tool to facilitate the due diligence process. With such an important role in business operations today, let’s look at some best practices for managing a virtual data room.

Why use a Virtual Data Room

A virtual data room has become the required solution for businesses needing a secure and organized way to share confidential documents with third parties. During due diligence for M&A, partnering, fundraising, asset sales, and other transactions, virtual data rooms can provide organizations and other parties with a way to conduct business efficiently and safely. With the increase of cyber threats and a rise in digital protection breaches, security is of paramount importance to businesses today. This is perhaps one of the most essential components of all online data rooms.

The online data room can also serve as a point of reference for various processes and procedures within an organization including marketing, sales, and operations. A data room could become very beneficial when the company is involved in major financial or acquisition deals. Housing troves of confidential data and intellectual property, the online data room, also known as a virtual deal room, can facilitate the efficient completion of all major deals and transactions. As an important hub for information and a collaboration tool, VDRs need to be organized and carefully structured for maximum efficacy.

Prepare for the Future

In many cases, organizations are in the business of buying and selling. While this is the goal, future deals and transactions are not necessarily easy to predict. A buyer or a seller may not have considered a transaction until an offer comes along. In this instance, it would be important to have a virtual data room already populated with sensitive data and important information. An already-populated VDR could save vital time and money in an M&A process. A best practice for industries using VDRs for transactions is to start populating a virtual data room sooner rather than later. Doing so could prepare organizations for future transactions that may occur as the business progresses.

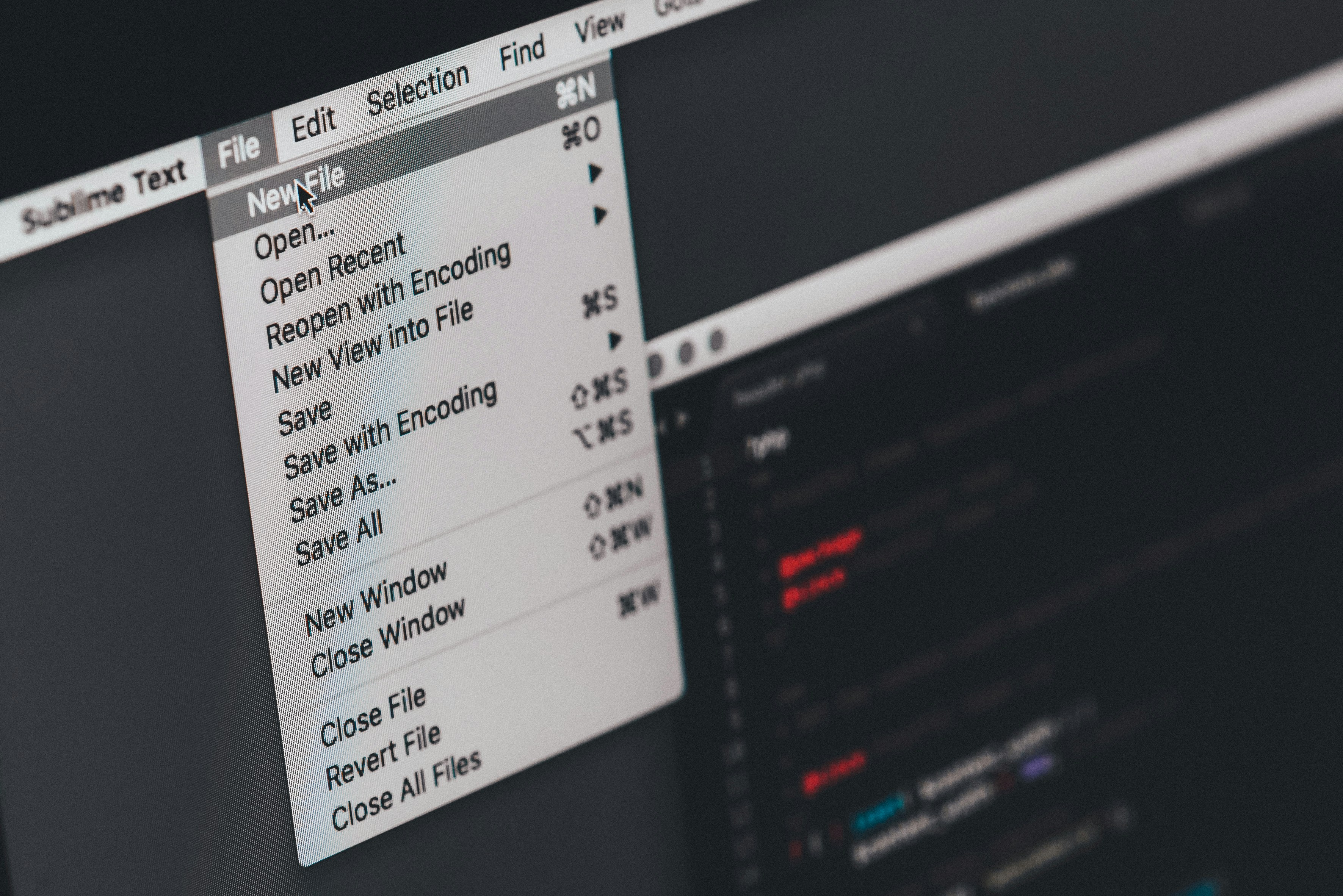

Present Organized and Structured Content

A well structured and organized VDR will be intuitive and will easily display information. This will ensure that confidential data and secure information is presented in a structured, and professional manner, that allows efficient review on all devices. As a best practice for uploading and organizing files, there needs to be a uniform method for classification and naming structures. If this is not done, files, folders, and hierarchal organization can become confused quickly. A confused VDR will only complicate the processes involved in transactions. Implementing operating procedures for deciding what items go into the VDR, where they go, and how they are named will ensure that data rooms are neat and clean.

Monitor User Activity

Another best practice for managing the online data room is consistently tracking who’s seen what information, when, and for how long. It will also be important to monitor what actions each user took with the documents that were accessed to ensure security. A VDR administrator can generate detailed activity reports that could be necessary for compliance. Actively monitoring behaviors in the VDR, however, could also provide valuable business intelligence to aid with dealing with interested parties. Staying on top of the activity within the VDR will help to ensure confidentiality, help collaborate with potential buyers, and ensure complete control over sensitive information.

When managing a deal room on your company’s behalf, you need to be sure who has secure access to each individual document. Make sure to set up your data room carefully, and you’ll have the peace of mind that comes with knowing that your financial statements and other sensitive documents are secure and ready for any merger process that your company pursues.